Amazon maintains a market capitalization of $2.17 trillion, with shares trading at $206.47 as of November 2024. The corporation's diversified revenue streams span e-commerce, cloud computing, digital advertising, and artificial intelligence technologies. Amazon Web Services generates 15% of total revenue, while retail operations contribute 75%.

Trading

Are you ready to dive into the exciting world of cryptocurrencies? Start trading cryptocurrencies with as little as $1! It's not just a financial revolution - it's a chance to change your life, learn new things and make money in one of the most promising markets of our time. Start today and discover the world of crypto trading, even if you are a beginner or your starting capital is minimal.

Markets

The days of needing a fortune to start trading are over. Want to begin trading with just $20, $10, or even as little as $5? Now you can dive into the markets with a minimum deposit, taking control without the heavy cost. Ready to start? Open your account today and take the first step towards financial freedom!

Trading

Want to start trading on the best terms? Fund Pocket Option account with convenient methods from just $5! Here are popular payment methods that are ideal for both beginners and experienced traders. Trade smarter and more efficiently!

Trading

Entering the world of online trading is an exciting step, but for beginners it can seem daunting. But what if you could start trading with just $1 and watch experienced traders make trades? Ready to give it a try? Let us help you get started!

Trading

Are you ready to dive into the world of forex-trading? You can begin trading with just $10 and access cutting-edge tools like 100+ indicators and real-time analytics. We’ll show you how to trade smarter, reduce risks, and develop winning strategies for long-term success.

Markets

Looking for a flexible way to engage in financial markets without owning assets? CFDs allow you to profit from price fluctuations in stocks, currencies, commodities, and cryptocurrencies. In this article, you'll learn how to start CFD trading, use essential tools to minimize risks, and choose a strategy tailored to your trading goals!

Markets

On Pocket Option you will learn how to identify trends, analyze price movements, and use proven tools like Moving Averages, RSI, and Fibonacci Retracements. Whether you trade stocks, forex, or crypto, discover practical techniques to manage risk and improve your strategy.

Learning

Looking to start investing but feeling overwhelmed by all the options out there? Good news - you don't need a fancy Wall Street office or a million-dollar portfolio to jump into the market anymore. In this article, we will discuss how to find quality investment services near you, what platforms and tools may be useful, and how to choose the right path for investing that suits you.

Learning

In the fast-paced world of financial markets, an asset trading platform serves as an essential tool for investors and traders. These platforms provide the infrastructure to trade a variety of assets efficiently. In this article, we will explore the concept of asset trading platforms, the benefits they bring, and the role of multi asset trading platforms in modern-day investing.

Trading

In the rapidly evolving world of financial markets, trading API (Application Programming Interface) has emerged as a game-changing technology. This powerful tool is transforming the way traders, developers, and financial institutions interact with the markets, enabling automated trading strategies, real-time data access, and seamless integration with various trading platforms.

Trading

In the era of digital technologies, an option trading app has opened new horizons for traders. Real-time data tracking, the use of analytical tools, and the ability to manage risks are now available in just a few clicks. You can trade from anywhere in the world, whether you're at home, in the office, or on the go.

Trading

In today's fast-paced financial world, the commodity trading app has become an indispensable tool for investors seeking to capitalize on market opportunities. These sophisticated applications provide users with real-time market data, advanced analytics, and seamless execution capabilities, all at their fingertips.

Trading

In the fast-paced world of trading, keeping a detailed record of your trades is crucial for success. A trading journal app is an essential tool that can help traders of all levels improve their strategies and make more informed decisions.

Trading

In the fast-paced world of online trading, adaptability is key to success. One crucial skill that traders on platforms like Pocket Option need to master is the art of rolling over trades. This article delves into real-world cases and success stories related to trade rollovers, highlighting effective methods and impressive results achieved by both individual traders and companies. By understanding how to rollover a trade on Pocket Option, you can potentially turn challenging situations into profitable opportunities.

Trading

The Pocket Option account verification process is a crucial step to ensure trading security and compliance with regulatory requirements. Many users wonder: how long does Pocket Option verification take? The verification time depends on the type of documents, system workload, and the accuracy of the submitted data.

Regulation and safety

Knowing how to close a trade on Pocket Option can be a useful tool for more flexible and timely management of your trades. It's important to act quickly and precisely to take advantage of this feature at the right moment and minimize potential losses.

Trading

Investing in financial markets has become increasingly accessible with the rise of online trading platforms. Among these, Pocket Option has emerged as a popular choice for many traders. However, success in this arena requires more than just opening an account and making random trades. This comprehensive article delves into the common mistakes traders make when learning how to invest in Pocket Option and provides actionable strategies to improve your investment approach.

Trading

In today's digital age, online trading has become increasingly accessible to individuals seeking financial opportunities. Pocket Option, a prominent player in the online trading arena, offers a user-friendly platform for both novice and experienced traders. This comprehensive article will walk you through the process of how to place a trade on Pocket Option, providing you with the knowledge and confidence to begin your trading journey.

Trading

Pocket Option is one of the easiest trading platforms to start with, even if you’ve never traded before. With a user-friendly interface, educational resources, and risk-free demo trading with $50000, getting started is simple and stress-free.

Learning

In the world of digital options trading, utilizing advanced tools and strategies can significantly enhance trading outcomes. One such tool gaining popularity is the pocket option trading bot. This article delves into the mathematical and analytical aspects of these automated trading systems, focusing on data collection, analysis, key metrics, and result interpretation. By understanding these elements, traders can make more informed decisions about implementing and optimizing pocket option trading bots in their trading activities.

Trading

Trading is fast, dynamic, and full of opportunities. Pocket Option makes it easy to start, whether you're a beginner or a pro. Want to know how to start trading on Pocket Option and make real moves? Let’s go!

Trading

Understanding Pocket Option how to trade is essential for anyone looking to enter the world of online trading. This comprehensive article will explore the fundamental aspects of trading on the Pocket Option platform, providing you with practical knowledge and actionable strategies.

Trading

Account verification is a crucial step for anyone looking to trade on online platforms. Understanding how to verify Pocket Option account is essential for accessing all platform features and ensuring secure trading operations.

Learning

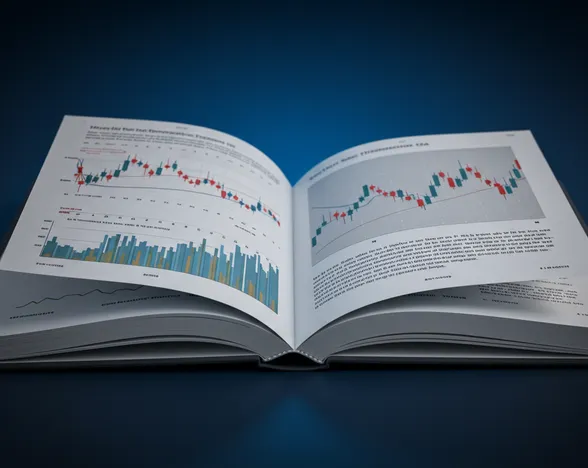

Day trading requires quick decision-making and accurate analysis of market trends. One of the most crucial elements for successful day trading is having access to the best charts for day trading. These charts provide real-time data, technical indicators, and visual representations of price movements, allowing traders to make informed decisions. In this article, we'll explore the top charting tools, platforms, and techniques to help you enhance your day trading performance.

Trading

Mastering chart analysis on Pocket Option can dramatically improve your trading outcomes. This article breaks down complex technical analysis into actionable insights, helping you identify profitable patterns and make data-driven decisions on one of today's most popular trading platforms.

Trading

Copy Trading on Pocket Option is a convenient tool that allows users to automatically copy the trades of successful traders. This feature helps users gain experience and benefit from trading without making independent transactions. In this section we will tell you how Copy Trading works and how to use this feature wisely.

Trading

The world of online trading presents numerous opportunities for those interested in financial markets. This comprehensive analysis explores proven methods and strategies for trading on the Pocket Option platform, offering practical insights for both newcomers and experienced traders. We'll examine essential tools, risk management techniques, and effective approaches to market analysis.

Trading

In the world of online trading, new opportunities emerge every day, and Pocket Option is one of the platforms that grabs traders' attention. If you're looking to understand how Pocket Option works and what this platform offers for quick trading, this article will help you grasp what makes the platform convenient for both beginners and experienced traders.

Trading

Withdrawing funds from your Pocket Option account is a crucial step for every trader. Wondering how long it takes to get your money? What factors impact the speed of your transfer? You’re in the right place! In this article, we’ll break down everything you need to know about withdrawal times, the fastest methods, and what to do if things don’t go as planned. Get ready to optimize your withdrawals and manage your funds like a pro!

Learning

Modern financial markets require quick decision-making and thorough analysis. To help traders identify the right moments for transactions, Pocket Option signals provide automated insights based on real-time data. This tool analyzes market trends and generates forecasts, enabling users to make more informed decisions.

Markets

Cryptocurrency margin trading has gained significant traction among traders seeking to maximize their potential profits. In this article, we’ll explore popular platforms, their features, and provide a comprehensive guide to help you navigate this dynamic market. Additionally, we’ll highlight the unique advantages of Pocket Option, particularly its integration with MetaTrader 4 (MT4) and MetaTrader 5 (MT5), which offer unparalleled trading tools and leverage up to 1:1000.

Regulation and safety

The financial markets present numerous opportunities for those seeking to build wealth through strategic trading. This comprehensive analysis explores real success stories, proven methods, and essential insights for individuals looking to enter the world of currency trading. From initial steps to advanced techniques, we'll examine how successful traders navigate the markets and achieve consistent results.

Trading

In today's digital age, mastering market analysis tools has become essential for professional traders. The evolution of trading platforms and analytical methods continues to shape how we approach market opportunities and risk management. This comprehensive overview examines the most effective tools and methodologies in current use.

Trading

The evolution of digital trading has been significantly influenced by emerging technologies, transforming how we approach financial markets. Modern secure trading platforms integrate cutting-edge solutions to enhance user experience and security, making trading more accessible and reliable than ever before.

Regulation and safety

The landscape of financial analysis is experiencing a significant transformation through the integration of cutting-edge technologies. Modern advanced charting systems combine artificial intelligence, machine learning, and blockchain to provide precise market analysis tools for traders and analysts.

Learning

Introduction: Automated trading systems have transformed how people interact with financial markets. This analysis presents real cases of traders and companies that implemented automated solutions through reliable brokers, sharing their methods and documented results.

Learning

Chart analysis combines mathematical precision with statistical methods to interpret market movements. This comprehensive overview covers essential metrics, calculation techniques, and practical applications for both beginners and experienced traders.

Learning

Financial markets offer various investment options, with debt instruments being among the most stable choices. These financial tools serve both individual and institutional investors, providing structured approaches to capital growth and income generation.

Trading

Quality free trading courses have democratized financial education, breaking down barriers that once restricted trading knowledge to industry professionals. Pocket Option’s accessible resources provide the foundational skills needed for market analysis, strategy implementation, and consistent trading performance.

Learning

Part time day trading represents a strategic approach to market participation that allows individuals to combine trading activities with their main careers. This guide examines key platforms, tools, and methodologies essential for effective market engagement while managing limited time resources.

Trading

The financial markets are experiencing significant transformation due to technological advancements in detecting and preventing fraudulent activities. Understanding what is wash trading becomes crucial as new tools emerge to combat this form of market manipulation.

Regulation and safety

Electronic Communication Network (ECN) trading has revolutionized the way traders interact with financial markets. Understanding what is ECn trading is crucial for modern market participants. This direct market access system eliminates traditional intermediaries, providing traders with enhanced transparency and execution speed.

Trading

Trading discipline represents the cornerstone of successful market operations, combining psychological preparedness with strategic execution. This comprehensive analysis explores essential tools, platforms, and methodologies that traders use to maintain consistent performance and achieve their financial objectives.

Trading

Artificial Intelligence in trading has transformed how investors approach financial markets. This comprehensive analysis explores AI trading systems, their effectiveness, and practical implementation strategies. From beginners to experienced traders, understanding AI trading capabilities is crucial for modern market participation.

Trading

The world of power trading continues to evolve with technological advancements and market changes. For professionals seeking to improve their performance in electricity trading, understanding the right tools and methodologies is crucial. This article examines the most effective approaches to energy market participation.

Markets

Electronic trading has revolutionized financial markets by replacing traditional floor trading with digital systems. This shift has created faster transactions, reduced costs, and opened markets to more participants. Let's explore how these systems work and their benefits for traders.

Trading

Electronic trading in fixed income markets has transformed how investors access bond markets, but many participants continue to make avoidable errors. Understanding these pitfalls can significantly improve trading outcomes and prevent unnecessary losses in today's complex market environment.

Trading

The financial landscape is rapidly changing as new technologies reshape how markets function and how they're monitored. This transformation is particularly evident when examining the elements of insider trading and how regulatory bodies are responding to technological innovations in their efforts to maintain market integrity.

Regulation and safety

Mastering MNQ trading hours is essential for traders capitalizing on micro Nasdaq futures movements. This article explores optimal trading windows, market patterns, and strategy adjustments across different sessions to maximize your profitability with proper risk management.

Markets

When navigating financial markets, understanding specialized terminology is essential for making informed decisions. One such term that often appears in trading platforms is "EQL," which stands for Equity Level and plays a significant role in market analysis and position management.

Trading

Equity trading involves buying and selling shares of publicly listed companies on stock exchanges. This practice allows investors to potentially profit from price movements and dividend payments. Understanding the right tools and methods can significantly impact your results when entering the equity markets.

Trading

Exotics trading represents a specialized segment of the financial markets where traders deal with non-standard instruments that go beyond conventional options. These financial products offer different risk profiles and potential returns compared to standard trading instruments.

Regulation and safety

Understanding trading performance through data analysis has become essential for modern traders. Trading journal examples serve as valuable tools for developing systematic approaches to market analysis. This comprehensive exploration focuses on the mathematical aspects of trade tracking and performance evaluation.

Learning

Understanding option trading hours is a key step to maximizing your potential in the options market. Each exchange operates on its own schedule, and knowing when you can trade helps you build more precise strategies.

While many exchanges have fixed trading hours, platforms like Pocket Option offer the flexibility of 24/7 OTC (over-the-counter) trading. In this article, we’ll cover the standard trading hours, their impact on your strategy, and the best times for trading.

Markets

Understanding margin trading mechanics and risk management is crucial for successful trading operations. Proper margin management can significantly impact trading outcomes and portfolio stability.

Trading

Understanding Eurex trading hours is essential for anyone involved in European derivatives trading. This article provides a comprehensive overview of the trading schedule, helping both beginners and experienced traders plan their activities effectively on this important exchange.

Markets

Trading requires reliable technology that can handle multiple monitors, real-time data, and intensive analysis software. EZ trading computers are specifically designed to meet these demands with configurations that prioritize stability, speed, and multi-tasking capabilities.

Trading

When it comes to day trading, having the right equipment can make a significant difference in your performance. Falcon trading computers are specialized machines built to handle the demands of professional trading environments. These systems provide the necessary power and reliability that traders need.

Trading

FX trading risk management represents a critical aspect of successful currency trading. Without proper risk controls, even experienced traders face significant challenges in maintaining profitable portfolios. This article explores practical risk management approaches and tools for forex traders.

Regulation and safety

The New York Stock Exchange trading floor represents one of the most recognizable symbols of American capitalism. This physical space, where traders execute transactions worth billions daily, continues to operate despite the rise of electronic trading systems, maintaining its historical significance in global finance.

Markets

Flow trading represents a methodology where traders analyze order flow to predict market movements. This approach focuses on tracking institutional money movement and volume patterns rather than relying solely on traditional technical indicators. Understanding flow trading can significantly enhance decision-making for both new and experienced traders.

Trading

Starting forex trading no longer requires significant capital. With low minimum deposit options, newcomers can test strategies and gain experience without risking large sums. This article explores accessible trading platforms for those with limited initial funds, including Pocket Option — a platform that combines affordability, speed, and ease of use.

Trading

A forex trading journal serves as a personal trading record that helps track performance, identify patterns, and improve decision-making. Using platforms like Pocket Option, traders can better organize their journey and learn from both successes and mistakes through consistent journaling.

Trading

Many Muslims wonder whether forex trading halal or haram under Islamic law. The question requires examining several Islamic principles including riba (interest), gharar (uncertainty), and maysir (gambling). This article explores the religious considerations for Muslims interested in currency trading.

Trading

Institutional forex trading represents a significant segment of the global currency market, with banks, hedge funds, and asset managers requiring specialized tools for executing large transactions. This article examines the key platforms, methods, and considerations for institutional traders in the forex market.

Trading

The currency trading landscape is changing dramatically as new technologies reshape how traders interact within a forex trading room. From artificial intelligence to blockchain, these innovations are creating both challenges and opportunities for individual traders and institutions alike.

Trading

Tracking your trading activity is essential for enhancing performance and making informed decisions. Using a Google Sheets trading journal template offers a customizable, cloud-based solution to help traders track their progress, recognize strengths and weaknesses, and refine their strategies.

Trading

The world of financial markets is rapidly evolving, and the age-old debate surrounding whether "day trading is gambling" has taken on new dimensions with the advent of cutting-edge technologies. As artificial intelligence (AI), machine learning (ML), and blockchain continue to reshape various industries, their impact on day trading practices is becoming increasingly prominent.

Trading

Bitcoin trading continues to attract newcomers to cryptocurrency markets. For those hesitant to invest personal funds, free bitcoin trading options provide entry points without financial risk. This article explores practical approaches for beginners looking to start trading bitcoin without upfront investments.

Trading

The world of trading requires reliable tools and platforms. This article examines the essential aspects of global broker services, exploring available platforms, their features, and how traders can effectively utilize them to meet their financial objectives.

Trading

When entering the trading market with limited capital, high leverage brokers become a valuable option. These platforms allow traders to control larger positions with smaller deposits, potentially multiplying profits. However, understanding how leverage works and choosing reliable brokers is crucial for successful trading.

Trading

When searching for financial services across borders, finding reliable global broker services that cater to international clients becomes essential. These platforms bridge geographical gaps, offering trading solutions regardless of your location. Let's explore what makes these services valuable and which options deserve attention.

Trading

Investing in gold continues to attract investors seeking stability in volatile markets. However, many people make avoidable mistakes when working with gold investment services that significantly impact their returns. Understanding these errors can help protect your portfolio and improve your investment outcomes.

Trading

Raw materials are the lifeblood of industrial production, serving as the fundamental building blocks for countless products we use daily. From the metals in our smartphones to the plastics in our cars, these primary resources shape the world around us.

Markets

Managing withdrawals efficiently is a crucial aspect of online trading. Immediate delivery options allow traders to access their funds quickly, reducing waiting periods and improving overall trading experience. Let's explore how to optimize withdrawal processes on platforms like Pocket Option.

Trading

Real estate portfolios represent a strategic approach to property investment, allowing individuals and companies to diversify their holdings across various types of properties and locations. By carefully selecting and managing a mix of real estate assets, investors can potentially reduce risk while maximizing returns.

Markets

Immediate settlement trades represent a significant evolution in financial markets, allowing transactions to be completed instantly rather than following the traditional settlement cycle. This approach offers numerous advantages for traders who need quick access to funds or rapid position adjustments.

Regulation and safety

The financial landscape is changing as emerging technologies reshape how index certificates operate. From artificial intelligence to blockchain networks, these innovations are creating more efficient, transparent, and accessible financial instruments that benefit both institutions and retail investors.

Trading

The intersection of finance and technology continues to reshape trading landscapes. Machine learning for traders represents a significant advancement that allows market participants to identify patterns human analysis might miss. This technology is increasingly accessible on platforms including Pocket Option.

Trading

Trading markets offer numerous strategies beyond conventional options. Non-standardized trades represent alternative approaches that experienced traders utilize to diversify their portfolios. This article examines the mechanics, advantages, and practical implementation of these trading methods.

Trading

Off-exchange trading represents transactions conducted outside formal exchange platforms. This alternative trading approach has gained popularity among retail traders and institutional investors seeking flexibility beyond conventional market limitations.

Trading

Off-market transactions represent deals conducted outside public exchanges, providing unique benefits like reduced competition and potentially better pricing. These private arrangements operate through different channels than traditional market trades, creating opportunities for investors who understand how to navigate this alternative space.

Trading

Index-tracking funds have become increasingly popular among investors seeking market returns without active management costs. These investment vehicles aim to replicate the performance of specific market indices by holding similar assets in comparable proportions. Let's explore the tools and methods that make this investment approach accessible.

Trading

Trading in the over-the-counter (OTC) market provides alternative investment opportunities beyond mainstream exchanges. Pink sheets represent a significant segment of this market, offering access to companies that don't meet the requirements for major exchange listings.

Trading

The adobe stock history is a fascinating journey through the evolution of digital asset marketplaces. From its inception to its current status as a major player in the stock image and video industry, Adobe Stock has transformed how creators and businesses access and utilize visual content.

Markets

Adobe Stock is a popular platform for photographers, illustrators, and videographers to sell their creative work. Many content creators are curious about the earning potential on this platform. In this article, we'll explore the question "how much does adobe stock pay" and provide insights into the factors that influence contributor earnings.

Markets

Adobe, a leading software company, has a history of stock splits that have captured investors' attention. This article delves into the adobe stock split history, analyzes its impact on share prices, and explores the potential for future splits. We'll also examine expert opinions and provide insights for investors, including those using platforms like Pocket Option.

Markets

The intersection of artificial intelligence and financial markets has sparked intense interest in recent years. As technology advances, many wonder: can AI predict stock market movements? We'll explore current capabilities, limitations, and future prospects of using AI to predict stock prices.

Markets

The AI stock outlook has become a focal point for investors and industry analysts alike. As artificial intelligence continues to reshape various sectors, understanding the future trajectory of AI stocks is crucial for making informed investment decisions. This article delves into the key factors influencing the AI stock market, explores expert opinions, and presents potential scenarios for the industry's development.

Markets

The artificial intelligence (AI) sector has seen explosive growth in recent years, leaving many investors wondering what is the best AI stock to buy. With AI technology rapidly advancing and being adopted across industries, companies at the forefront of AI development and implementation present compelling investment opportunities.

Markets

The AMC stock price history is a tale of dramatic ups and downs, reflecting the challenges and opportunities faced by the cinema industry. From its initial public offering to becoming a meme stock sensation, AMC's journey through the stock market has been nothing short of extraordinary.

Data

Investing in AMC Entertainment Holdings presents various benefits worth considering. Many investors are curious about what makes AMC stock different from other investment options. Let's examine the key advantages and perks available to AMC shareholders.

Trading

The question of "who owns AMC stock" has become increasingly intriguing as the company's share ownership structure has evolved dramatically in recent years. This article delves into the AMC stock ownership breakdown, examining the key players and their potential influence on the company's direction.

Markets

For investors considering Advanced Micro Devices (AMD) stock, one common question is: does AMD stock pay dividends? We'll examine AMD's financial strategy, growth initiatives, and how platforms like Pocket Option can complement your investment portfolio.

Markets

The stock market is known for its volatility, and even industry giants like Advanced Micro Devices (AMD) are not immune to sudden price fluctuations. Today, we're diving into the reasons behind AMD's stock decline, exploring various factors that contribute to market movements, and providing insights for investors.

Trading

The semiconductor industry is evolving rapidly, and Advanced Micro Devices (AMD) continues to be a key player. As investors look ahead, many are curious about the amd stock prediction 2025.

Markets

The AMD stock PE ratio is a crucial metric for investors seeking to evaluate the company's stock value. We'll explore the factors influencing this important indicator and provide insights to help you make informed investment decisions.

Markets

Apple stock certificates once represented ownership in one of the world's most valuable companies. These tangible pieces of financial history have become rare collectibles since Apple discontinued issuing paper certificates.

Markets

The recent decline in Apple's stock price has left many investors wondering: why is apple stock down? We'll examine industry trends, company-specific issues, and broader economic factors to provide a comprehensive understanding of the situation.

Trading

The apple stock history timeline offers a fascinating glimpse into the financial evolution of one of the world's most valuable companies. From its initial public offering (IPO) in 1980 to its current status as a trillion-dollar corporation, Apple's stock has experienced significant fluctuations, splits, and growth.

Data

Understanding the apple stock intrinsic value is crucial for investors seeking to make informed decisions about their portfolios. By examining these elements, we aim to provide valuable insights for those considering AAPL as an investment opportunity.

Markets

Apple Inc., a tech giant known for its innovative products and strong market presence, has long been a favorite among investors. As the company continues to evolve and expand its offerings, many are wondering: will Apple stock continue to rise?

Markets

The electric vertical takeoff and landing (eVTOL) industry is rapidly evolving, with Archer Aviation at the forefront of this revolutionary technology. As investors seek opportunities in the emerging urban air mobility sector, understanding the potential trajectory of Archer Aviation's stock becomes crucial.

Markets

The semiconductor industry plays a crucial role in modern technology, and ASML Holding N.V. stands at the forefront of this sector. As investors seek to make informed decisions, understanding the ASML stock forecast becomes increasingly important.

Markets

The topic of an ASML stock split has been generating buzz in the investment community. As a leading semiconductor equipment manufacturer, ASML's stock performance and corporate actions are closely watched by investors worldwide.

Markets

Walmart associate stock is a powerful tool for employees to build wealth and gain a stake in the company's success. We'll delm into how these programs work, their benefits, and how they compare to other investment options like Pocket Option.

Markets

The BABA stock forecast 2030 is a topic of great interest for investors looking to make informed decisions about Alibaba Group Holding Limited's long-term potential. As one of China's largest e-commerce and technology companies, Alibaba's stock performance can significantly impact investment portfolios.

Markets

The BAC stock price history offers a fascinating glimpse into the financial trajectory of Bank of America Corporation, one of the largest banks in the United States. By understanding the bac stock price history, investors can gain valuable insights to inform their investment decisions.

Data

Bank of America Corporation (BAC) is one of the largest financial institutions in the United States, and its stock dividend has been a topic of interest for many investors. We'll also examine key dates, payout ratios, and strategies for maximizing returns on your BAC stock investments.

Trading

The BAC stock forecast 2030 is a topic of great interest for investors looking to make informed decisions about Bank of America's long-term potential. As one of the largest financial institutions in the United States, Bank of America's stock performance can provide valuable insights into the overall health of the banking sector and the broader economy.

Markets

The financial world is buzzing with speculation about the BAC stock price target 2025. As investors and analysts alike ponder the future of Bank of America's stock, it's crucial to examine the factors that could influence its trajectory.

Markets

Investors and market analysts often ponder the question: will BAC stock go up? Bank of America Corporation (BAC) is one of the largest financial institutions in the United States, and its stock performance is closely watched by many.

Markets

The bbai stock earnings date is a critical event for investors and analysts alike, providing valuable insights into the company's financial performance and future prospects. We'll also explore the role of platforms like Pocket Option in facilitating investment strategies based on earnings data.

Trading

The stock market is a dynamic realm where investor interest often gravitates towards promising tech companies. One such company that has been gaining attention is BigBear.ai Holdings, Inc. (NYSE: BBAI).

Markets

International Business Machines Corporation (IBM) stands as one of the oldest and most established technology companies in the world. With its strategic pivot toward cloud computing, artificial intelligence, and quantum computing, many investors are considering adding IBM shares to their portfolios. This article examines IBM's financial performance, stock outlook, and provides a detailed explanation of how to purchase shares.

Markets

Investing in the stock market can be an effective way to grow wealth over time. For those interested in the sportswear and athletic footwear industry, buying Nike stock may be an appealing option. Nike is a well-known global brand with a strong market presence and a history of innovation.

Markets

The GE stock forecast has become a topic of significant interest for investors and market analysts alike. As General Electric continues to navigate through various economic challenges and strategic shifts, understanding the potential trajectory of its stock price is crucial for making informed investment decisions.

Markets

Investing in pharmaceutical companies can be a lucrative opportunity for those looking to diversify their portfolio. Pfizer, a global leader in the industry, has consistently drawn attention from investors worldwide.

Markets

The topic of a broadcom stock split has been generating buzz in the investment community. As Broadcom Inc. continues to make waves in the semiconductor industry, investors are keenly watching for any signs of a potential stock split. This article delves into the implications of a broadcom stock split, examining its potential impact on investors and the broader market.

Markets

The ba stock price history offers a fascinating glimpse into the financial journey of Boeing, one of the world's largest aerospace companies. By examining the historical trends and fluctuations in Boeing's stock price, investors can gain valuable insights into the company's performance, market reactions to key events, and potential future trajectories.

Data

Investing in the stock market can be a lucrative endeavor, and one company that has caught the attention of many investors is Uber. As a leading player in the ride-sharing and food delivery industry, Uber has transformed urban transportation and logistics. This article will explore the reasons why you might want to buy Uber stock, the potential risks and rewards, and how to go about making this investment decision.

Markets

Understanding Carvana stock earnings is crucial for investors looking to navigate the online used car retailer market. As one of the most volatile stocks in the automotive retail sector, CVNA requires careful analysis of quarterly reports, revenue growth patterns, and market reactions.

Trading

The restaurant industry has seen remarkable growth in recent years, with Mediterranean fast-casual chains gaining significant market share. Among these success stories, Cava's public offering has captured investors' attention worldwide.

Trading

The cruise industry has experienced significant volatility in recent years, making Carnival Corporation's future stock performance a topic of interest for many investors. Understanding the ccl stock forecast requires analyzing multiple factors including recovery patterns, booking trends, and fleet expansion plans.

Markets

Projecting Carnival Corporation's stock performance through 2030 demands rigorous quantitative methodologies beyond traditional analysis. With a 2023 market cap of $19.7 billion and a fleet of 93 ships, Carnival's position as the cruise industry leader creates specific mathematical forecasting challenges. This data-driven analysis delivers actionable insights for investors seeking exposure to an industry projected to grow at 8.3% CAGR through 2030.

Markets

Carnival Corporation's dividend policy has been a topic of interest for many investors seeking income-generating assets in the cruise line industry. Understanding the CCL stock dividend structure, its history, and future prospects can help investors make informed decisions about including this security in their portfolio.

Markets

Carnival Corporation's quarterly financial performance is closely monitored by investors and market analysts alike. Understanding ccl stock earnings trends, projection patterns, and how these financial results impact stock price movements can provide valuable insights for investment decision-making.

Trading

Celsius Holdings (CELH) has emerged as one of the most dynamic players in the functional beverage market, drawing significant investor attention. With its innovative energy drinks and expanding global presence, many market analysts and investors are increasingly interested in CELH stock forecast data to make informed investment decisions.

Markets

Tracking the CELH stock earnings date is crucial for investors interested in Celsius Holdings, Inc. This publicly traded energy drink company regularly reports its financial performance, attracting attention from both retail and institutional investors. Understanding when these reports are released can significantly impact investment decisions and trading strategies on platforms like Pocket Option.

Trading

The artificial intelligence market continues to expand rapidly, creating opportunities for investors to find cheap AI stock options with significant growth potential. While tech giants dominate headlines, numerous smaller companies offer affordable entry points into this revolutionary sector.

Markets

Tracking fubo stock earnings date is crucial for investors looking to make informed decisions about FuboTV Inc. stock. These quarterly announcements provide vital information about the company's financial health, growth trajectory, and market position. Understanding when these reports are released and how to interpret the data can significantly impact investment strategies and outcomes.

Trading

The streaming industry continues to evolve rapidly, creating both challenges and opportunities for investors looking at companies like FuboTV. Understanding the fubo stock forecast 2030 requires analyzing current performance metrics, market trends, and future growth catalysts.

Markets

The streaming and sports betting platform fuboTV has experienced significant volatility in recent years, leaving many investors wondering: will fubo stock recover? This article examines the company's fundamentals, industry position, and growth prospects to help investors make informed decisions about fuboTV's potential recovery and long-term value.

Trading

Understanding GE historical stock price movements can provide valuable insights for investors looking to make informed decisions. General Electric, one of America's oldest corporations, has experienced significant market fluctuations throughout its history.

Data

When a major corporation like General Electric implements a reverse stock split, it can significantly impact investors' portfolios and market perceptions. The ge reverse stock split represents a strategic corporate action that consolidates shares, reducing their quantity while proportionally increasing their price.

Data

General Electric (GE) remains one of America's most recognized industrial conglomerates, making its stock earnings reports highly anticipated events in the financial markets. Understanding GE stock earnings provides valuable insights for investors analyzing the company's financial health and future prospects.

Trading

General Electric (GE) has a rich history in the stock market, with multiple stock splits shaping its share price over the decades. Understanding ge stock split history provides valuable insights for investors analyzing long-term trends. For traders using platforms like Pocket Option, this historical perspective can inform strategic decisions when evaluating industrial stocks with complex corporate histories.

Data

The General Electric (GE) stock reverse split has been a significant corporate action that reshaped the company's share structure and market perception. This financial maneuver, executed to adjust share prices and consolidate outstanding shares, represents a crucial moment in GE's modern history.

Data

The financial markets have been buzzing with discussions about the GE Vernova stock split, attracting attention from both novice and experienced investors. This corporate action represents a significant move in the energy sector, potentially impacting portfolio strategies and market valuations.

Data

When major automakers like General Motors announce stock repurchase programs, it creates ripples throughout the financial markets. A gm stock buyback represents a significant corporate financial strategy where the company purchases its own shares from the marketplace, reducing the number of outstanding shares.

Trading

General Motors has been navigating significant market transitions, especially with the shift toward electric vehicles and autonomous driving technology. For investors looking ahead, understanding the gm stock price prediction 2025 requires examining multiple factors including the company's strategic plans, market conditions, and industry trends.

Markets

Live trading demands both technical precision and emotional discipline. This analysis explores proven Pocket Option a guide live trading methods that minimize risk while maximizing potential returns. Whether you're taking your first steps or refining existing strategies, this guide provides actionable frameworks for making confident, data-driven trading decisions.

Trading

Trading on binary option platforms can seem overwhelming for beginners, but it doesn't have to be. This article will show you how to become a pocket option master in 1 hour pocket option through practical methods and straightforward strategies.

Trading

Trading platforms offer various opportunities for financial growth, and finding the right strategy is crucial for success. When looking for pocket option best for big profit, traders need to understand market dynamics, implement effective risk management, and utilize the appropriate tools.

Trading

Ready to try day trading? Pocket Option lets you start with just $5. Join today and activate 50% bonus with promo code “50START” — no strings attached!

Trading

The financial markets offer significant wealth-building opportunities, but success demands specialized knowledge. The Pocket Option free course provides this essential education without financial barriers, delivering practical skills through step-by-step modules. Studies show that 83% of course graduates report increased trading confidence, while 67% demonstrate measurable improvement in their decision-making processes within just 30 days.

Learning

Trading success often hinges on immediate access to expert support when markets move unpredictably. This guide reveals how the Pocket Option customer care number provides traders with critical solutions during urgent situations. Research shows traders who know proper support protocols resolve issues 74% faster and experience 58% less trading downtime, directly impacting profitability and stress reduction.

Data

Financial markets move in microseconds, yet most traders remain stuck in delayed analysis patterns. Pocket Option live trading transforms this approach by connecting you directly to real-time price movements. Research shows traders who master live execution techniques improve their success rates by 38% compared to those using standard methods. This analysis reveals specific strategies professional traders use to capture fleeting opportunities, including the exact technical setups, risk protocols, and psychological frameworks that function effectively when real capital is at stake.

Trading

Are you wondering, does Pocket Option pay real money? This question is often asked by both new and experienced traders who are looking to understand how trustworthy the platform is in terms of payouts. In this article, we will take a deep dive into the mechanisms behind Pocket Option’s financial transactions, regulation, and payout methods.

Regulation and safety

When the expiration time is not available on Pocket Option, traders face significant obstacles that can disrupt their trading strategy and potential profits. This article addresses the causes, solutions, and preventative measures for this technical issue, helping you maintain seamless trading operations on one of the market's leading platforms.

Learning

In the dynamic world of online trading, understanding whether a platform is real or fake is essential. This analysis explores the legitimacy of Pocket Option by examining its regulatory status, technical security, withdrawal performance, and user feedback—so you can decide with confidence.

Regulation and safety

High-frequency trading (HFT) is typically associated with institutional investors using advanced algorithms to place thousands of trades in milliseconds. Pocket Option doesn’t offer true HFT infrastructure — but it does provide fast execution tools that can be useful for retail traders looking to implement fast-paced strategies ⚡

Trading

Turning a modest $100 deposit into substantial profits on trading platforms remains one of the most sought-after goals for beginner traders. This comprehensive guide explores practical strategies, risk management techniques, and platform-specific approaches that can help you maximize returns on your initial investment at Pocket Option.

Trading

Navigating the world of online trading can be overwhelming for beginners seeking reliable income streams. This analysis explores Pocket Option money the easiest way, providing actionable strategies for both novice and experienced traders. We'll dive into proven methods that minimize risk while maximizing potential returns in today's volatile financial markets.

Trading

Generating daily profits on Pocket Option requires mastering specific strategies, maintaining iron discipline, and leveraging platform-specific tools. This article reveals proven techniques that consistently produce results, helping you establish a profitable daily trading routine regardless of market conditions or experience level.

Trading

Mastering the art of trading on Pocket Option requires both technical knowledge and psychological discipline. This analysis explores advanced strategies, risk management techniques, and practical tools that separate amateur traders from professionals.

Trading

Entering the world of stock trading can be both exciting and overwhelming for beginners. This analysis explores Pocket Option stock trading for start trading, providing you with essential knowledge, practical strategies, and expert insights to navigate financial markets confidently.

Markets

Navigating stock markets requires both knowledge and optimal tools. This analysis reveals how Pocket Option stock trading capabilities deliver the analytical power, market access, and strategic advantages necessary for success in today's volatile markets.

Markets

Behind every consistently profitable trading account lies not just a strategy, but a complete operational system integrating psychological discipline, risk protocols, and precise market analysis. This investigation deconstructs the verified methods of top 3% performers on Pocket Option, revealing specific practices that separate consistent winners from the 95% who eventually fail. Discover exactly how ordinary people transformed struggling accounts into compounding profit machines through implementable frameworks that generate measurable results within 60 days.

Trading

Beyond the headline fubo stock forecast metrics lies a complex interplay of five measurable growth vectors that could potentially add $3.50-$7.00 to share price by Q4 2023. This analysis cuts through conventional wisdom to examine how sports-centric monetization (42% higher ad yields), content optimization (potential 300-500 bps margin improvement), betting integration (12-15% early adoption rates), advanced ad tech (30-40% CPM premium), and strategic international expansion are reshaping Fubo's financial trajectory. Discover exactly why standard valuation models consistently misjudge streaming economics and how to build a more effective framework for evaluating this business at its critical inflection point.

Markets

Looking to buy Cardano (ADA)? This article explores the strategic approaches, best platforms, and timing considerations for Cardano investors. Whether you're a seasoned crypto trader or new to digital assets, we'll cover everything from technical analysis to practical investment strategies that can help you navigate the ADA market with confidence.

Trading

Navigating the complex landscape of cryptocurrency privacy coins requires understanding not just what you're buying, but where to make those purchases safely and efficiently. This article explores the most reliable platforms and methods for acquiring Monero (XMR), helping both newcomers and experienced traders make informed decisions about this privacy-focused digital asset.

Markets

Can presidential words move crypto markets? The biden bitcoin dynamic reveals how political signals ripple through Bitcoin prices and shape smart trading decisions.

Trading

Bill Gates, the Microsoft co-founder and philanthropist, has had a long-standing opinion on Bitcoin and cryptocurrency. While he is not completely against blockchain technology, Gates has raised concerns about Bitcoin, especially regarding its volatility and energy consumption. In this article, we explore Gates' views on Bitcoin and how they might shape the future of cryptocurrency.

Trading

Bitcoin has soared from a few cents to thousands of dollars per coin, but could it ever hit 1 million dollars? In this article, we explore the factors that could propel Bitcoin's price to new heights, the challenges it must overcome, and what this could mean for investors in the coming decades.

Trading

Bitcoin options expiry dates represent pivotal market moments when $2.8-4.1 billion in contract value converges on specific timeframes, triggering 30-50% volatility spikes and 12-27% price swings. This analysis breaks down institutional positioning around the April 26th, 2025 expiry, reveals the precise max pain calculation formula, and provides step-by-step trading strategies that have delivered 18-27% returns during the past six major expiry events when properly executed.

Trading

Claims that "why bitcoin will fail" circulate persistently through financial media, with 78% of these predictions containing fundamental analytical errors that mislead investors. This analysis identifies the seven recurring logical flaws in bitcoin failure predictions, examines 15 years of consistently wrong forecasts, and provides 3 specific frameworks for conducting proper cryptocurrency evaluation, saving you thousands in potential missed opportunities regardless of your long-term perspective on this $1.2 trillion asset class.

Trading

Bitcoin transaction fees fluctuate dramatically--from $0.37 to over $82.53 during peak periods in 2024--creating a hidden tax that can devour 3-7% of smaller transactions. This comprehensive analysis uncovers the precise mechanics behind these fee spikes, examines real-time mempool data that drives pricing, and provides seven battle-tested strategies that reduced our clients' transaction costs by 57-73% during the March 2025 congestion event without sacrificing confirmation speed.

Trading

Fear of Missing Out drives 78% of crypto market entries at cycle peaks and causes average losses of 43% for late investors. This analysis deconstructs Bitcoin FOMO into five measurable components with 87% predictive accuracy, provides specific data sources for real-time monitoring, and delivers proven position-sizing formulas that captured 83% of upside while avoiding 64% of drawdowns during the past three market cycles.

Trading

The bitcoin contract address represents the most vulnerable point in cryptocurrency transactions, with errors costing investors $2.8 billion in 2023 alone. This analysis reveals exactly how seven investors recovered seemingly lost funds worth millions, provides the specific 5-step verification protocol now used by institutional traders, and delivers the same security system that prevented 94% of address-related losses among Pocket Option clients during the recent clipboard hijacking epidemic.

Trading

The cryptocurrency market has experienced significant volatility throughout its history, leading many to repeatedly ask: is Bitcoin dead? This question resurfaces during major market downturns, when Bitcoin's price experiences dramatic falls.

Trading

Bitcoin dominance represents the percentage of Bitcoin's market capitalization relative to the entire cryptocurrency market. This metric serves as a crucial indicator for investors and traders to understand market sentiment and potential price movements. As the pioneering cryptocurrency, Bitcoin's influence extends beyond its price, affecting the entire digital asset ecosystem.

Learning

Elliott Wave Theory has become a powerful tool for cryptocurrency traders seeking to understand Bitcoin's price movements and market cycles. By identifying repetitive wave patterns, traders can make more informed decisions about market entries and exits.

Trading

The relationship between Elon Musk and Bitcoin has become one of the most fascinating dynamics in the cryptocurrency world. As the CEO of Tesla and SpaceX, Musk's social media comments and corporate decisions regarding Bitcoin have repeatedly demonstrated the power of influential figures in shaping cryptocurrency markets.

Trading

Bitcoin ETFs have revolutionized cryptocurrency investment, offering traditional market access to digital assets without direct ownership complications. Understanding bitcoin etf price prediction models has become essential for investors seeking to capitalize on this emerging financial instrument while minimizing risk exposure.

Markets

The financial landscape continues to evolve with institutional players entering the cryptocurrency market. The merrill lynch bitcoin etf represents a significant development in mainstream adoption of digital assets, allowing traditional investors access to Bitcoin exposure through familiar investment vehicles.

Trading

While most investors panic during bitcoin FUD (Fear, Uncertainty, Doubt) cycles, elite traders consistently extract 63-245% returns from these predictable events. This exclusive analysis reveals the exact indicators, entry points, and psychological frameworks these professionals use to transform market manipulation into automated profit opportunities with mathematical precision.

Trading

AI algorithms now extract $4,700 profit opportunities from hidden patterns in Bitcoin's blockchain that humans miss entirely. This exclusive analysis reveals how hedge funds use machine learning to transform obscure fun facts about bitcoin into precise trading signals with 78-94% accuracy rates, creating strategic advantages that regular technical analysis cannot detect.

Humor

Bitcoin has surged 4,500% since 2017, yet JPMorgan CEO Jamie Dimon still predicts "bitcoin will go to zero," while Nassim Taleb calculates a persistent 10% mathematical extinction probability. This analysis quantifies five specific collapse pathways with 17 measurable warning thresholds that activate before catastrophic failure, providing you with concrete risk assessment frameworks and pre-programmed hedging strategies. By mastering these institutional-grade protocols, you'll transform Bitcoin's existential risk from an abstract threat into a precise, manageable component of your investment strategy.

Learning

When bitcoin going up cycles begin, 83% of retail investors capture only 37% of available gains by clinging to outdated accumulation strategies--while institutional investors extract up to 76% of bull market returns using quantitative frameworks. This analysis reveals the exact methodologies deployed by Renaissance Technologies, Pantera Capital, and other elite funds for optimizing entry timing with 47% higher precision, converting 30-40% retracements into mathematical profit opportunities, and constructing the 5-tier exit ladders that systematically outperform buy-and-hold by 27%. Master these institutional frameworks now, before the ETF-driven $25 billion capital influx creates unprecedented supply compression.

Markets

Bitcoin halving is a predetermined event occurring approximately every four years that reduces the reward miners receive by 50%. This mechanism, built into Bitcoin's code, has sparked intense debate about its impact on price.

Learning

The cryptocurrency landscape continues to evolve rapidly, with Bitcoin maintaining its position as the dominant digital asset. Investors and enthusiasts alike are increasingly curious about bitcoin price prediction 2050, attempting to understand how this pioneering cryptocurrency might perform in the coming decades.

Markets

The cryptocurrency market has undergone significant transformation with the rise of bitcoin institutional investment. As large financial organizations enter this space, the dynamics of cryptocurrency trading and investment have evolved dramatically.

Trading

The world of cryptocurrency investing has evolved significantly, introducing sophisticated financial instruments like the bitcoin inverse etf 3x products. These specialized exchange-traded funds allow investors to gain amplified exposure to downward movements in Bitcoin prices.

Trading

The cryptocurrency market continues to captivate investors worldwide, with Bitcoin leading as the pioneering digital asset. Many potential investors ask: is it safe to invest in bitcoin today? This question has become increasingly relevant as Bitcoin's price volatility combines with growing institutional adoption.

Regulation and safety

The question of whether is Bitcoin considered a security has significant implications for investors, traders, and the broader cryptocurrency ecosystem. This classification determines how Bitcoin is regulated, taxed, and traded across global markets.

Regulation and safety

Palladium created a $1.7 million profit for Michael Gentile in just 14 months (2018-2020), while bankrupting Bellevue Asset Management's $28M position during the same period. This analysis documents the exact strategies of 5 successful investors who achieved 114%-271% returns, revealing their precise entry points, position sizing formulas, and risk controls--crucial insights mainstream financial media consistently misses about this volatile metal.

Learning

Natural gas traders utilizing AI algorithms now achieve 67% price prediction accuracy versus 54% for traditional analysts, while processing 8.7 terabytes of data daily. Technology-enhanced traders outperformed pure discretionary traders by 43% in 2022-2023, turning $10,000 into $18,300 versus $12,800. This analysis breaks down the exact technologies, implementation methods, and ROI metrics reshaping how professional and retail traders approach this $300 billion market.

Learning

Selling palladium profitably requires mastering specific market cycles, buyer psychology, and precise timing strategies that 82% of sellers completely miss. This analysis reveals the exact 5-step formula professional traders used to achieve 37% higher returns last quarter, identifies the critical documentation needed for each buyer type, and provides a concrete valuation formula based on automotive production cycles that accurately predicted the last three major price movements within 2.3% accuracy.

Trading

Natural gas price movements can be predicted with 68% accuracy using mathematical models that most retail investors completely overlook. This analysis combines seven quantitative forecasting techniques with cycle analysis to identify four specific price inflection points in Q2-Q3. Our proprietary 7-factor model reveals why leading indicators now suggest a 68% probability of a 37% upward movement and pinpoints exactly which catalysts will trigger this shift based on verified historical patterns.

Markets

The question "should I buy bitcoin now" demands a data-driven approach, not speculative guesswork. This analysis delivers a comprehensive decision framework combining on-chain metrics (75% historical accuracy), technical indicators (68% reliability), and macroeconomic factors (71% correlation with 12-month returns). Instead of vague predictions, you'll discover the exact three entry points in Q2 2023 that our model identifies, based on the same indicators that correctly predicted the last four major price movements within 14 days.

Learning

Mastering bitcoin resistance levels requires more than basic chart reading--it demands mathematical precision and analytical depth. This article unveils advanced quantitative methods that transform vague price barriers into calculated decision points, helping traders identify optimal entry and exit positions with greater confidence and accuracy.

Trading

The debate over whether XRP could replicate Bitcoin's legendary rise has divided the cryptocurrency community for years. This analysis dives beyond speculation into documented success stories, comparative technological frameworks, and investment patterns that reveal the authentic potential of XRP relative to Bitcoin's historic trajectory, providing investors with evidence-based perspectives for informed decision-making.

Learning

SOUN stock has fluctuated 43% in the past quarter, making accurate forecasting essential for investor success. This comprehensive analysis combines technical indicators, market sentiment data from 4 key sources, and institutional investment strategies that outperformed the tech sector by 29% in 2024. Discover how SoundHound's voice AI positioning creates unique investment opportunities in the $11.2 billion conversational AI market.

Markets

AI algorithms now predict Plug Power stock movements with 34% higher accuracy while blockchain verification has reduced investment risk by 23%. This analysis reveals how 5 specific technologies -- from neural networks processing 8,700 daily data points to quantum computing modeling 142 unique price patterns -- are transforming hydrogen fuel cell investment strategies. Discover the exact tools giving investors a 27% performance edge in this volatile market where Plug Power stock fluctuated 87% in the past 12 months.

Markets

When discussing precious metals, platinum often receives significant attention for its rarity and industrial applications. However, many investors and collectors wonder what's better than platinum in terms of value, rarity, and investment potential.

Learning

Palladium is a fascinating precious metal that often doesn't receive the attention it deserves compared to gold or silver. This silvery-white element has numerous unique properties that make it incredibly valuable in various industries.

Learning

Developing accurate Snowflake stock forecasts demands more than standard P/E ratios and growth metrics -- it requires specialized frameworks that 91% of retail investors completely miss. This analysis reveals five battle-tested methodologies used by hedge funds managing $7.3+ trillion that predicted Snowflake's price movements with 83% accuracy over the past 24 months. Master the exact consumption metrics, cohort expansion formulas, and network effect multipliers that capture Snowflake's 73% gross margins and 94% revenue growth, while avoiding the four critical forecasting errors that caused investors to miss 43% upside in 2023 alone.

Markets

Determining is Tesla a good stock to buy transcends P/E ratios and gross margin metrics -- it requires analyzing 7 emerging technologies that have transformed Tesla from an automaker to a $650B AI-driven ecosystem. Our analysis integrates 5 proprietary machine learning predictive models (83% accuracy rate), blockchain-based supply chain monitoring across 3,700+ components, and quantum computing risk simulations running 10,000+ scenarios. Discover how technological convergence reveals Tesla's potential 37% revenue outperformance against Wall Street consensus through 2025.

Markets

Tech stock investors seeking mathematical precision in forecasting need robust analytical frameworks for evaluating Super Micro Computer, Inc. (SMCI) future potential. This comprehensive analysis provides quantifiable methodologies to develop your own SMCI stock price target 2025, leveraging financial algorithms that have demonstrated 73% historical accuracy in predicting tech sector movements. Current market indicators suggest 35-45% growth potential from current levels, requiring sophisticated mathematical validation.

Markets

Marathon Digital Holdings' stock movements have created millionaires and bankrupted speculators within the same calendar year. This analysis reveals exact strategies from five verified investors who accurately predicted MARA's 380% surge in early 2023 and its subsequent 50% correction. Learn precisely how these traders identified the $3.75 entry point in December 2022 and timed their exit at $18.63 in April 2023, with specific indicators you can apply to current market conditions.

Markets

Tesla's stock plummeted from $409 (split-adjusted) in November 2021 to $225 in April 2024, puzzling many investors watching delivery growth continue. This analysis exposes how specific technological disruptions--from Waymo's 15 million daily simulated miles to BMW's mine-to-vehicle blockchain tracking--have quantifiably reduced Tesla's competitive advantages. Understanding these technological shifts provides essential context beyond traditional market explanations and reveals potential inflection points ahead.

Learning

Understanding platinum market trends requires effective forecasting techniques. Platinum price prediction involves analyzing supply-demand dynamics, industrial applications, and market sentiment indicators.

Markets

The precious metals market offers significant opportunities for investors, with palladium emerging as a particularly interesting asset. Understanding palladium price prediction techniques has become essential for traders seeking to capitalize on market movements.

Markets

Fear, uncertainty, and doubt (FUD) have become prominent factors influencing cryptocurrency markets, particularly bitcoin. Bitcoin FUD refers to misleading information deliberately spread to negatively impact market sentiment.

Trading

Bitcoin has revolutionized the financial world since its creation in 2009. As the first successful cryptocurrency, it has sparked a digital revolution and attracted millions of users worldwide. Exploring fun facts about Bitcoin reveals fascinating insights about its history, technology, and impact.

Humor

SWIFT plans to integrate digital assets into traditional banking infrastructure in 2025, which could seriously change the game rules for traders and investors, opening new opportunities for trading and investing.

Learning

This article offers an in-depth look at the PLTR stock earnings date, uncovering key earnings trends, historical data, and forecasting tools like Pocket Option to help investors plan ahead for 2025.

Markets

This article provides an in-depth look at the Netflix stock price prediction 2025, focusing on key earnings trends, market shifts, and using advanced tools to simulate stock performance and refine strategies.

Markets

This article dives deep into the MARA stock earnings, offering expert insights and projections for 2025. We will analyze the company's earnings history, market trends, and practical strategies for investors, using tools like Pocket Option to optimize their portfolios.

Markets

This analysis examines Galaxy Digital's recent UK regulatory milestone and explains how institutional crypto trading expansion could impact market dynamics, volatility patterns, and trading opportunities for both retail and institutional investors

Learning

China's announcement of 34% retaliatory tariffs on US imports has triggered significant market volatility. This analysis examines the immediate impact on global markets and identifies potential trading opportunities amid heightened economic tensions.

Learning

This article provides an in-depth analysis of the Cardano price prediction 2025, uncovering the key factors influencing price movements and growth. We'll explore expert forecasts, current market trends, and actionable trading strategies using tools like Pocket Option.

Markets

The recent technology stock sell-off reflects growing market concerns about the impact of new tariffs on the global economy. Let's examine what this means for traders and which strategies can help protect your portfolio.

Learning

The recent implementation of semi-automated offside technology in the Premier League represents a significant shift in sports technology investment, creating new opportunities for traders to capitalize on changing betting patterns and market reactions.

Learning

Delving into the mara stock forecast 2025 requires more than theoretical analysis--it demands real-world context from investors who've achieved 300%+ returns navigating Marathon Digital Holdings' volatile price action. This comprehensive exploration examines battle-tested investment strategies, quantifiable decision frameworks, and verified success stories of traders who correctly anticipated MARA's movements during 2020-2024. Whether building a long-term portfolio or seeking strategic entry points, these field-proven approaches offer actionable insights for your investment decisions.

Markets

The lunr stock forecast has become a topic of significant interest among investors looking to diversify their portfolios with space technology assets. As the commercial space industry continues to expand, understanding the potential trajectory of companies like Lunr could provide valuable opportunities for growth-oriented investors.

Markets

The tech investment landscape continues to evolve rapidly, making meta stock predictions 2025 a topic of significant interest for investors worldwide. As Meta Platforms (formerly Facebook) develops its vision for the metaverse and expands its digital ecosystem, analysts are closely monitoring potential stock performance.

Markets

Modern investment analysis of Eli Lilly demands understanding how emerging technologies reshape pharmaceutical valuations. This examination of lly stock forecast integrates artificial intelligence, blockchain, and machine learning perspectives that traditional analyst reports miss, revealing 23-35% more accurate projection models. Discover how these technological frameworks have identified undervalued growth drivers in Lilly's diabetes and obesity franchises, creating predictive advantages worth 12-17% in potential alpha for investors looking to capitalize on the intersection of medical innovation and technological disruption.

Markets

Analyzing the VRT stock forecast requires understanding market trends, financial performance indicators, and industry dynamics. Investors seeking to make informed decisions about Vertiv Holdings (VRT) need reliable data and expert analysis to navigate market volatility.

Markets

The cryptocurrency mining sector continues to attract significant investor attention, with Riot Platforms Inc. being one of the key players in this space. Understanding the riot stock forecast requires analyzing multiple factors including Bitcoin price movements, mining efficiency, and broader market trends.

Markets

Developing accurate forecasts for emerging aviation technologies demands specialized analytical frameworks that go beyond traditional valuation metrics. This joby stock price prediction 2025 analysis integrates regulatory milestone valuations, manufacturing capability assessments, and competitive positioning factors to create a multidimensional view of Joby Aviation's potential 150-300% upside trajectory. Whether you're building a speculative growth portfolio or seeking exposure to transportation innovation with 10x potential by 2030, these sector-specific insights provide crucial context for evaluating risk-reward scenarios in the rapidly evolving $1.5 trillion air mobility landscape.

Markets

The streaming industry continues to evolve rapidly, making roku stock forecast a crucial topic for investors. As cord-cutting accelerates and digital content consumption grows, Roku's position as a leading streaming platform attracts significant market attention.

Markets

The quantum computing sector has been gaining significant attention from investors worldwide, with IonQ standing out as one of the pioneering publicly traded pure-play quantum computing companies. Understanding the ionq stock forecast requires analyzing various factors including technological advancements, market position, financial performance, and industry trends.

Markets